income tax calculator indonesia

Point 13 multiplied by 12. Generally the VAT rate is 10 percent in Indonesia.

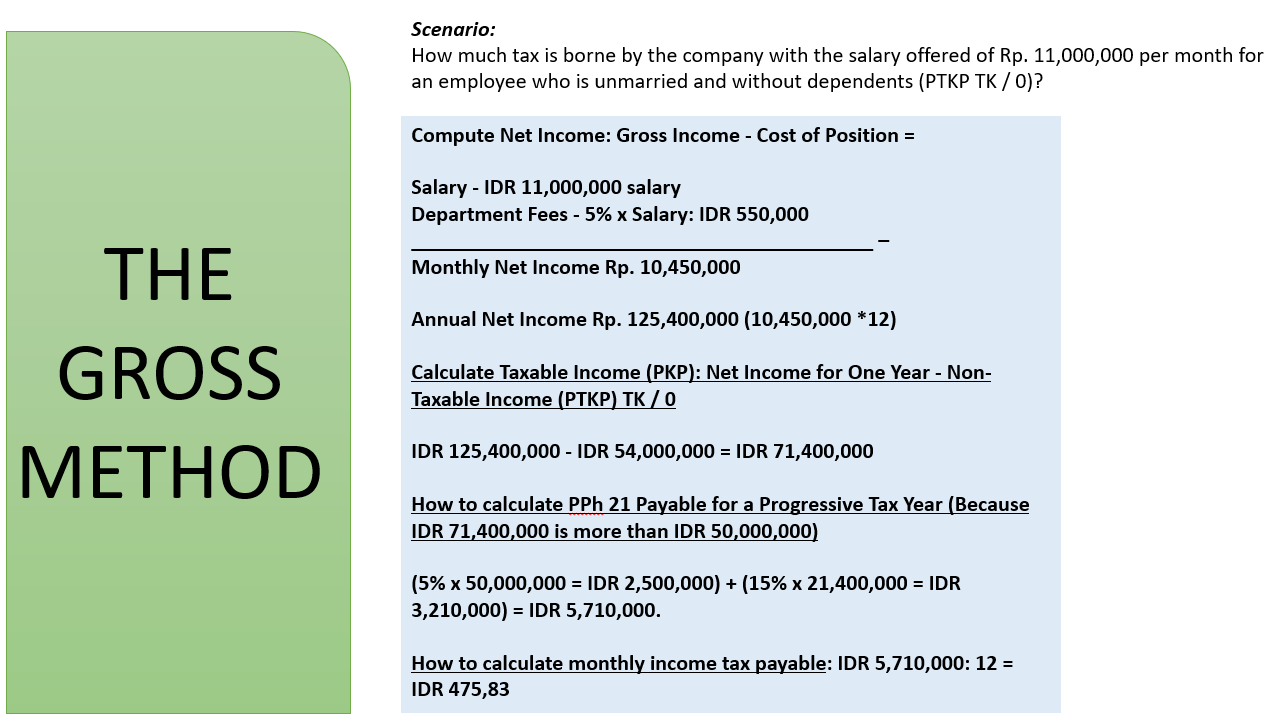

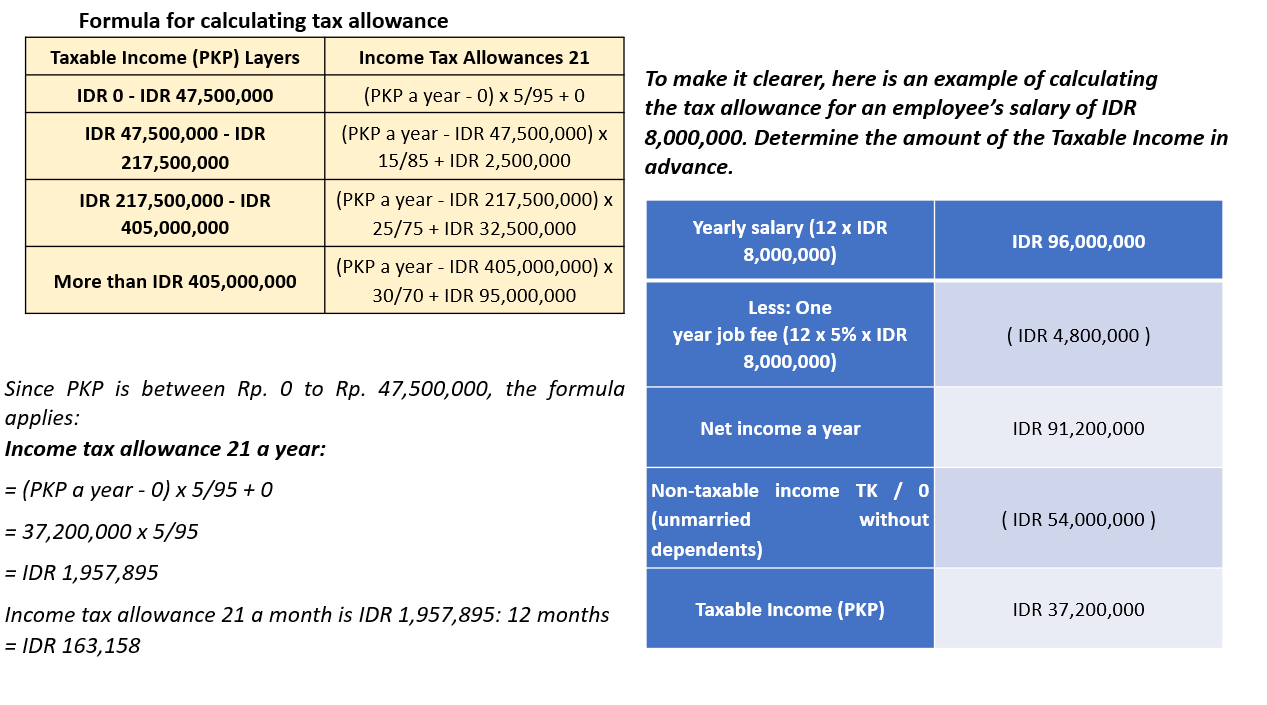

How To Calculate Income Tax In Excel

Calculate your income tax in Indonesia salary deductions in Indonesia and compare salary after tax for income earned in Indonesia in the 2022 tax year using the Indonesia salary after tax calculators.

. Long Term Capital Gains Covered us 112A 10. Public Companies tax discount of 3. Deductions for an individual are Rp.

50 million rupiah or less 5. Enter your salary into the calculator above to find out how taxes in Indonesia affect your income. 5 of the relevant amount.

Personal income tax in Indonesia is determined through a self-assessment system meaning resident tax payers need to file individual income tax returns. Indonesia adopts a self-assessment system. Indonesian tax resident and non-resident taxpayers who have Tax Identification Numbers Tax-ID are generally taxed on a.

Fastest tax refund with e-file and direct deposit. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for. In Indonesia tax services are provided by Deloitte Touche Solutions.

The IRS issues more than 9 out of 10 refunds in less than 21 days. In-kind benefits paid for by the employer such as. For payments for year three onwards the ordinary individual tax rates apply.

Listing requirement of 40. Indonesian residents qualify for personal tax relief as seen in the table below. TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate.

Except for self-assessed VAT on utilization of intangible taxable goods andor. However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation. The calculator only includes the individual tax free allowance of IDR 24300000.

Annual PPh 21 Tax. 250 million to 500 million rupiah 25. VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent.

Indonesian Tax Guide 2019-2020 9 3. Calculators IRS Penalty Calculator. 10 is levied on the total gains on capital if.

If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000. In Indonesia a general flat rate of 25 applies becoming 22 in 2020. The Indonesia Tax Calculator is a diverse tool and we may refer to it as the Indonesia wage calculator salary calculator or Indonesia salary after tax calculator it is however the same calculator there are.

However if your company is a public company that satisfy the minimum listing requirement of 40 in Indonesia Stock Exchange IDX and. Resident tax payers are subject to progressive tax rates ranging from 5 percent to 30 percent. The tax authorities have the right to audit any tax return to ensure the individual has correctly calculated the tax payable within the 5-year statute of limitations.

This field is adjusted toward your status Eg. If you make 0 a year living in Indonesia we estimate that youll be taxed 0. Taxpayers can extend the period of submission of the annual income tax return for 2 two months at the maximum by submitting notification to the ITA.

Indonesia - utilizes the self-assessment method for individuals to calculate settle and report income tax. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. Thus resident taxpayers have to calculate and settle ie if the Annual Individual Income Tax Return AIITR is showing underpayment amount and submit for the AIITR accordingly.

Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget. Non-residents are subject to 20 withholding tax on any income sourced within Indonesia. Above IDR 50 million.

Dividend income us 115BBDA 10. In addition to salary taxable employment income includes bonuses commissions overseas allowances and fixed allowances for education housing and medical care. More than 500 million rupiah 30.

This worldwide tax brackets calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates and. Personal Income Tax Rate Rp An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above. Winnings from Lottery Crossword Puzzles etc 30.

Tax refund time frames will vary. Income Liable to Tax at Normal Rate ---. Annual Salary After Tax Calculator.

2 x 600000000 12000000 Personal allowances 54000000 3 x 4500000 67500000 Pension contribution. How to calculate the total cost of import in Indonesia. Tax IDR Up to IDR 50 million.

There is a wide variety of taxes in Indonesia that companies investors and individuals need to comply with. Deposit Penalty Calculator. This is an income tax calculator for Indonesia.

Interest on deposits us 80TTB Any other deductions. This includes corporate income tax personal income tax withholding taxes international tax agreements value-added tax VAT and many more. The rates are final and applied only if the payment is made at once or in two years at the maximum if the payment is made in sequence.

Indonesia Salary Calculator 2022. Special cases for taxation. Total Annual Net Income.

While the flat rate for corporate income tax stands at 22 20 from 2022 onwards there are discounts available selected group of companies in Indonesia. 21 Income Tax rates. Corporate Income Tax Rate.

Employment income in Indonesia is subject to tax regardless of where the income is paid. 2880000 wife 2880000 and up to three children Rp. To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula.

2 1 8939700 178794. Annual gross income. Short Term Capital Gains Covered us 111A 15.

Calculate tax scenerios with income tax brackets from over 200 countries around the globe. What are The Rates For Personal Income Tax in Indonesia. 50 million to 250 million rupiah 15.

Given the consequences of non-compliance foreign workers should seek help from registered local tax advisors to better. Taxable annual revenue on individual tax residents is charged at the following progressive rates. A quick and efficient way to compare salaries in Indonesia review income tax deductions for income in Indonesia and estimate your tax returns for your Salary in Indonesia.

Annual Tax Exempt Income. Pay for TurboTax out of your federal refund. As per Section 112A of the Income Tax Act 1961 earnings are made after the sale of listed securities which has to be more than Rs.

Occupational expenses 5 from gross income or maximum 6000000 6000000 Old age saving contribution paid by employee. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations. Fulfilment of other conditions such as shares must be owned by a minimum of 300 parties.

Calculate Employee Income Tax in Indonesia. In general the tax applicable on long term capital gains is 20 surcharge cess as applicable. A 40 Refund Processing Service fee applies to this payment method.

Personal Income Tax Calculator In Indonesia Free Cekindo

Personal Income Tax Calculator In Indonesia Free Cekindo Di 2021

Singapore Income Tax Calculator Corporateguide Singapore

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide

Personal Income Tax Calculator In Indonesia Free Cekindo

Salary Tax Calculator Bd For Android Apk Download

Taxation System In Indonesia Your Guide To Income Taxation

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

What You Need To Know About Tax Income Calculation In Malaysia Career Resources

Taxation System In Indonesia Your Guide To Income Taxation

Personal And Corporate Income Tax Indonesia How To Calculate It

Indonesia Salary Calculator 2022 23

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Foreigner S Income Tax In China China Admissions